Investment Education Pricing

Choose the program that matches your learning goals. Each tier builds comprehensive knowledge while respecting the complexity of financial markets.

Foundation Program

- Market fundamentals and terminology

- Basic portfolio theory concepts

- Introduction to equity and bond markets

- Risk assessment fundamentals

- Monthly group sessions with instructors

- Access to educational trading simulator

- Course materials and research database

- Certificate of completion

Professional Program

- Advanced derivatives and options strategies

- Portfolio optimization techniques

- Alternative investment analysis

- Risk management methodologies

- Weekly instructor consultations

- Real market case study projects

- Industry software training sessions

- Professional certification preparation

- Networking events with industry professionals

Master Certification

- Complex structured products analysis

- Quantitative modeling techniques

- Institutional investment strategies

- Advanced risk measurement systems

- One-on-one mentorship sessions

- Thesis project with faculty guidance

- Guest lectures from industry experts

- Internship placement assistance

- Master-level certification

- Alumni network access

Program Comparison Details

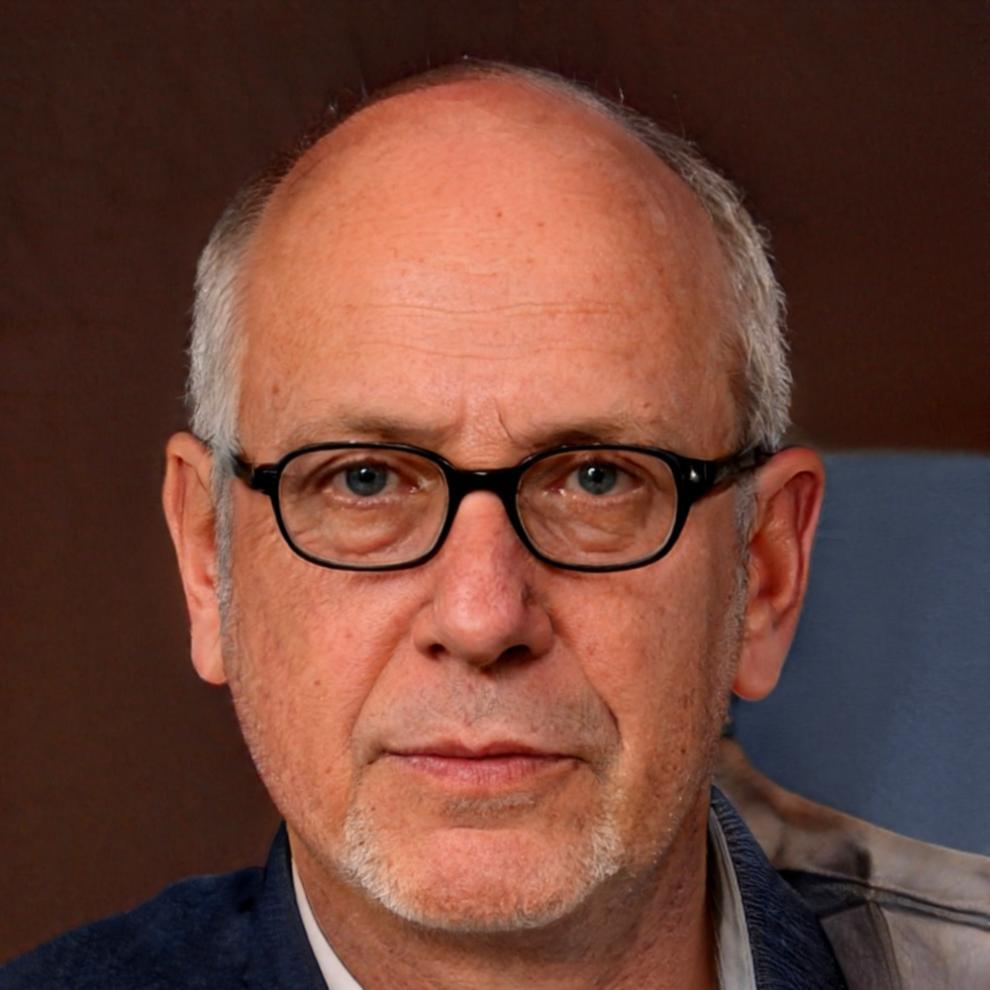

Dominik Svensson

"The program structure made complex concepts manageable. After 18 months, I understood portfolio theory well enough to confidently discuss investment strategies with colleagues. The weekly sessions were worth every dollar of the tuition."

Aleksander Petrov

"The depth of analysis we covered surprised me. Two years felt long at first, but understanding quantitative models takes time. The mentorship component helped me avoid common mistakes that could have cost thousands in real trading."